In brief

- Kiwis most concerned about cost of living/inflation.

- Next is crime, housing affordability, and the state of the economy.

- Bank profits soften to 18-month low.

- Housing market shows signs of changing.

Inflation and crime top concerns for New Zealanders

Inflation/cost of living is New Zealand’s leading concern, says results market research firm IPSOS in their latest poll.

Retail crime could be the reason crime is the number two concern amongst New Zealanders. By some estimates it’s currently costing Kiwi families around $800 each per year, with retailers raising their prices to cover the cost of theft.

Concerns regarding housing affordability, and the overall state of the economy, are tied for third and fourth place. Education concerns are rising rapidly.

Declining concern over fuel prices since the beginning of the year, compared to other issues, may change as prices at the pump jump as the Government reinstates its $0.25 p/litre tax on 1 July 2023.

Vehicle sales decline

In May, vehicle sales were down by almost 10%. They were also down in April. So far there is a year-to-date decrease of about 4% in vehicle sales overall.

Bank profits softening in the last 18 months

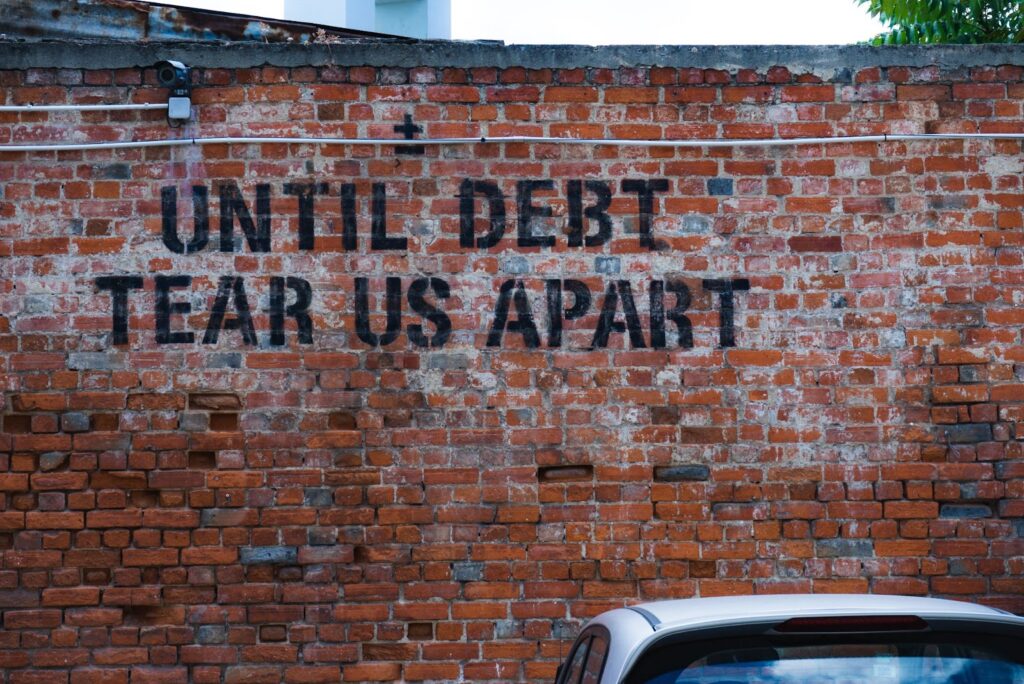

Bank profits in New Zealand have fallen to their lowest level since the beginning of 2021. The key driver is “an increase in money set aside for bad and doubtful debts.”

The softening of bank profits reflects the impact of rising interest rates, consumer prices, and customers’ ability to meet loan repayments. Banks are bracing for future credit losses.

The Commerce Commission has launched a 14-month-long investigation into New Zealand’s banking sector to assess competition and the quality of personal banking services. A draft report is expected next year.

The Green Party has been advocating for this investigation. They want immediate action to address what they consider excessive bank profits.

Increase in house sales in May, but overall less homes for sale

There was a 7.5% increase in house sales in May compared to May, 2022. But there are about 28% fewer homes for sale over roughly the same period.

Sellers are adjusting their price expectations, so the gap between asking and selling prices is shrinking.

Plotting NZ house prices against the NZ money supply and gold prices

House prices typically map closely to the money supply, but comparing New Zealand house prices to New Zealand gold prices gives an interesting perspective. When compared to the price of gold, New Zealand median house prices have fallen 46% since 2005.

Gold is often viewed as a barometer of inflation. Perhaps high property prices in recent years is a result of too much money printing, not an increase in value. However, since gold is priced in US dollars, there is a lot of volatility when measured in NZ dollars