In brief

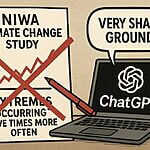

- The government changed the way it measures its net debt last year.

- New assets, like NZ Super, have been added to offset actual debt.

- Are some of these assets, like loans due to Kainga Ora and students, really as solid as others?

Out with the old

In 2022 the way the government measures and presents the net debt was changed with little fanfare. The new measure is said to bring New Zealand in line with other countries and – due to its similarity to measures used by Australia and the International Monetary Fund – “improve comparability” of the government’s fiscal position.

This explanation may well be accurate. But was it really done at the behest of the treasury with no political encouragement? Very fortuitous for a government obsessed with optics.

It is surprising that such a big change was accepted by the media at face value, because it’s ideal for a government that has borrowed enormously yet can now point to a lower net debt to GDP ratio.

It is beyond the mandate of NZNE to get into the fine details, as any meaningful analysis is a big job. So we will just say the reason the net debt to GDP ratio came down is not that there is now less debt. Instead, certain assets, which existed, but were ignored with the previous calculation, are now counted as offsets to the debt. The majority of these assets are real, for instance publicly traded securities, but there are some assets, such as debt owed to the government by its own departments, which seem more theoretical.

Also, by far the biggest offset is the assets held by NZ Super. These have to be used for future superannuation payments, which claims are not listed as liabilities. So is it fair to consider NZ’s debt reduced by this asset? Apparently the accountants think so, but a business might not.

In with the new

The new net debt measure creates the illusion of lower debt levels overall when the actual amount owing is higher.

A new debt limit was put in place for the new measurement, it is 30% of GDP, down from 50% of GDP under the old measure. This limit isn’t hard and can be broken in case of emergencies like floods, cyclones or economic recession.

It is hard to be sure, with some expenses paid out of COVID funds set aside from an earlier budget, but it seems net debt is increasing at something in the order of $10B year.

The old measure will continue to be published alongside the new measure in the short term for comparison.